Summations, Line Items, Total Number

The Total Rewards overview section is usually the first financial information employees see when opening their statement. First impressions count.

When designing your company’s new Total Rewards Statement, start by thoughtfully organizing all of your compensation line items into groups, called summations. Continue reading below in this page’s Specifics section to learn all about summations.

An organized structure helps your employees easily understand and navigate all of the financial value you provide them every year.

As you get started, list out all possible rewards and perks before building out the other, more detailed, sections of your statement.

Align your summations with employee’s existing understanding of their compensation and benefits packages, so that you’re promoting the Principle of Least Surprise . If programs or perks you offer have a “brand name” you’ve used in other communications or benefits portals, reenforce those brands in your rewards statement.

Everyone will appreciate the clarity, then tell their family and friends about their wonderful company and all the awesome perks!

Screenshots

Specifics

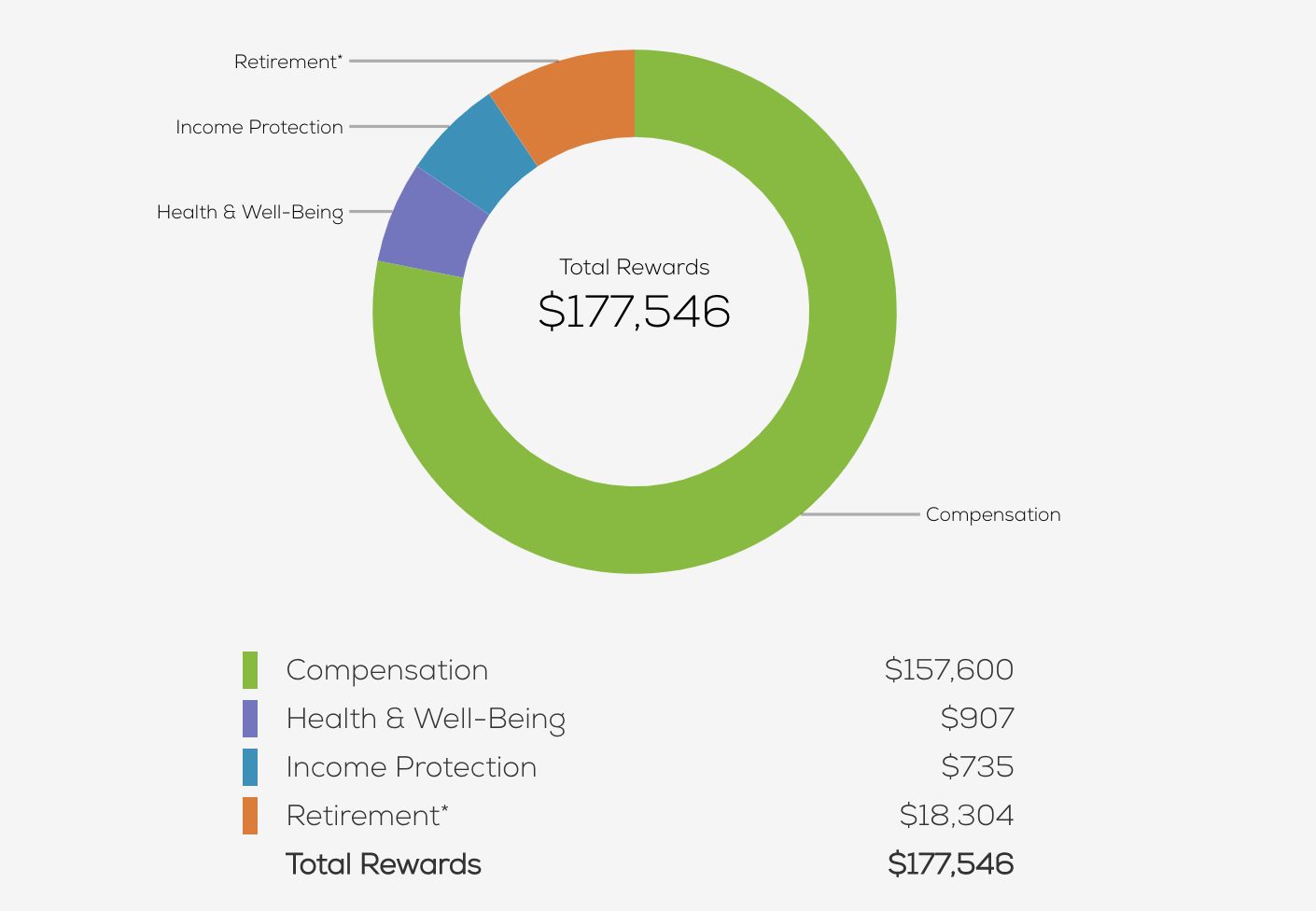

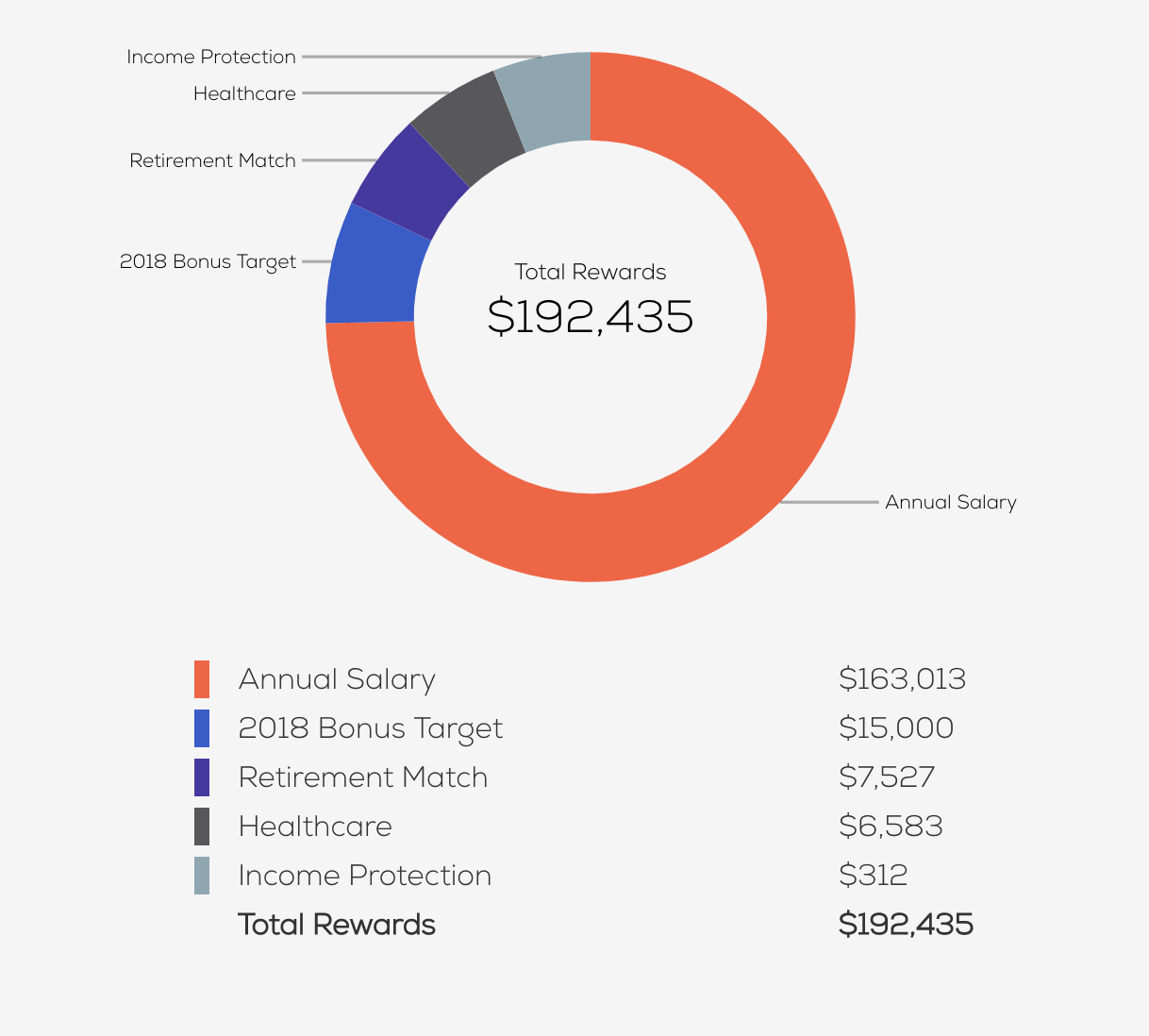

Visualization - A powerful method of communicating financial information. Total Rewards summations and total numbers can be shown as Pie carts, Donut Charts, Tables, Legends. Albert has great flexibility to show visualizations in both online and print formats. Currency can be represented in US or International Currencies, and can also contain decimals, or just displayed as an integer.

Albert helps you organize the your Total Rewards hierarchy into three layers:

Compensation Line Item - The most granular level. Line items are financial amounts of each individual benefit or cash payment and are personalized to each of your employee’s actual values. Compensation line items typically don’t include amounts that the employee pays for like Voluntary Pet Insurance; these employee-paid values are reported in other sections of the statement.

Example Compensation Line Items:

- Employer Cost of Medical coverage

- Employer Cost of Dental Coverage

- Employer 401K Match

- Manager Pension

- Educational Tuition Reimbursement

Summation - The middle level. Summations are simply line items added together to form logical buckets of financial value that are easy for employees to understand. Summations are personalized: If the line items in a summation for an employee add up to zero, then we automatically hide the summation in the statements and the visualizations. Summations can be ordered by importance, typically we order by the largest amounts first and the smallest amounts last.

Example Summations:

- Healthcare = Employer Cost of Medical coverage + Employer Cost of Dental Coverage

- Retirement = Employer 401K Match + Manager Pension

- Education = Educational Tuition Reimbursement

Total Number - The top level! This is the total financial value you’re providing your employee each year.

Example Total Number:

- Total Rewards = Healthcare Summation + Retirement Summation + Education Summation

By the transitive property of addition, it all adds up: all line items added together = all summations added together = the total number!

🤓

Samples

Here are some popular summations we’ve seen helping benefit teams design their Total Rewards statements:

- Cash Compensation = Salary + Bonus + Overtime + Incentives + Awards + LTI (Long-term Incentives)

- Retirement = Employer 401K Match + Pension

- Equity = Stock Options + Stock Appreciation Rights

- Health and Wellness = Employer Paid Medical + Employer Paid Dental + Employer Paid Vision + EAP

- Income Protection = Employer Paid Life + AD&D + Employer Paid Short-TermDisability

- Additional Benefits = Gym Membership + Education Tuition Reimbursement + Retail Discounts + Service Awards